City budget includes water rate increase, pay bump

Published 7:00 am Thursday, June 15, 2023

- The city has approved the FY2024 budget.

VALDOSTA – Valdosta residents face a 5% water rate increase while city employees will receive 3% pay raises.

The increases are part of the city’s multi-million dollar Fiscal 2024 budget unanimously approved following a recent second public hearing.

Trending

The estimated fund balance for July 1 sits at $223,920,029, while the fund balance for June 30, 2024, is expected to be $232,286,039.

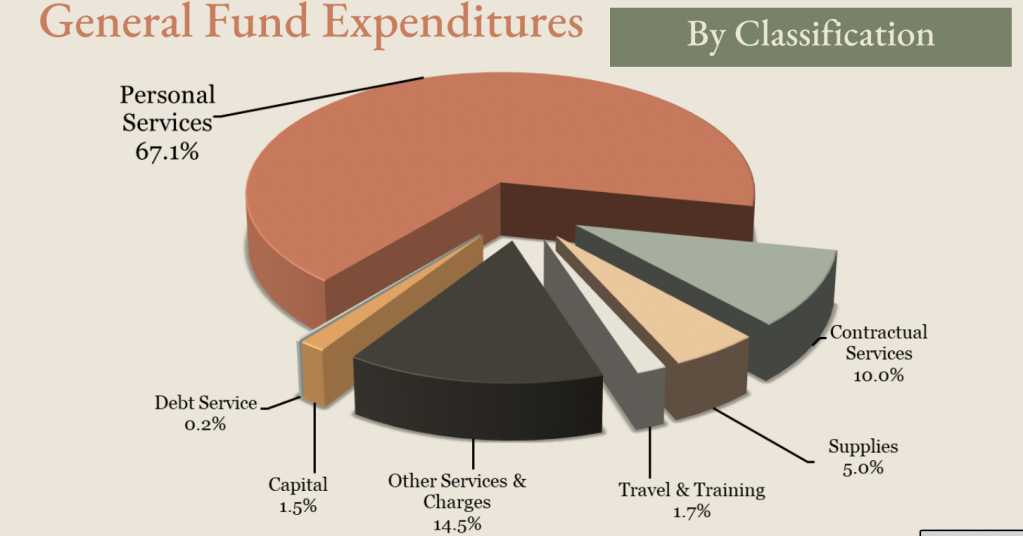

The general fund comes in at $47,959,833 with $26,598,538 being set aside for capital projects.

Justin Elliot, partner for the Mauldin & Jenkins accounting firm auditing the city, broke down the general fund and expenditures to City Council previously this month.

“So far, when talking about the general fund, you got about $18 million in assets, about $2.5 million in cash. That’s really good. That’s what you want to see. You ended up with about a fund balance equity of about $13 million. and also, when reviewing the income statement, you also had revenue of about $40 million. You had expenditures of about $37 (million), so about $2 million in net income at the end of day after everything was in the general fund,” he said.

Special revenue funds are set at $6,705,035 and enterprise funds come to $42,712,886. Internal service funds is budgeted at $17,484,465.

According to city officials, the FY2024 budget does include a 5% utility rate increase based on a water rate analysis and sufficiency study commissioned by the City Council.

Trending

The General Fund Budget is considered balanced, calls for no millage rate increase, city leaders said.

The proposed budget includes a 3% cost of living adjustment for career employees effective July 1.

The city’s medical clinic continues to be funded in this proposed budget, with no increase in employee contributions for any city benefit offered.

The consolidated budget decreased $2.2 million when compared to FY 2023. There are increases in personnel line items due to new positions being added and the 3% COLA. Those expenses are partially offset by smaller cuts across the city, officials said.

Projected Revenue:

— Taxes: $68,575,583

— Locally generated non-tax revenues: $50,150,635

— Revenues from other Governments: $4,611,112

— Capital contributed to fund: $7,726,136

— Receipts from other city funds: $10,432,857

Total revenue from those sources comes to $141,496,323.

Projected Uses of Funds:

— Operating Expenditures: $96,858,139

— Capital Expenditures: $52,966,419 688

— Capital Distribution: $28,339,583

— Debt Service: $1,212,481

— Disbursements to Other Funds of the City: $10,432,857

Total Uses: $133,130,313

Excess (Deficit) of Sources Over Uses: $8,366,010